Instead of buying a rental property (plus another downside to consider)

In a recent article we compared building an ADU with buying a rental property and shared 4 advantages of building an ADU on an existing property compared to buying a new rental property. We also shared one drawback. You can read that article here: 4 reasons to build an ADU instead of buying a rental property, and one downside

We wanted to share 4 more reasons that savvy real estate investors and homeowners are adding an ADU on their existing property instead of buying a new one.

- Building an ADU pro: Flexibility for future use We have worked with several clients that want to set up a multi-generational living situation in a few years. Often they see their baby-boomer aged parents getting older and although they are still living independently, a few years from now they might need a little more help. Since it can take a year to design, permit, and build an ADU, many homeowners don’t want to wait until an aging parent has a fall or an illness and suddenly needs assisted living help. They decide to build an ADU on their property now and rent it out for a few years knowing that it will be ready to welcome a parent to age in place when or if that becomes a need. Bottom line: An ADU is flexible to meet homeowner needs for both additional income and to be ready to house a parent to age in place down the road.

- Building an ADU pro: Property taxes In some jurisdictions property taxes do not increase for improvements to existing properties. Homeowners should check with their tax assessor here, but even if taxes do increase, often they do not increase as much as they would if a homeowner were buying an entirely new rental property. This means that the operating costs of an ADU is less as a percentage of rental income. The same can be true for insurance and certain fixed utility fees like stormwater or base sewer/water fees. Bottom Line: The operating expenses are often lower on an ADU because of efficiency in property taxes, insurance, and utility fees.

- Building an ADU pro: Lower Financing Cost Many homeowners are locked into their current residence by a sub 5%, or even sub 3% primary mortgage. If they were going to buy a new rental property they would need to obtain a new mortgage for the rental property at today’s higher interest rates but the entire purchase of the property. If they are building an ADU to add onto their current home, they can often finance this through a Home Equity Line of Credit (HELOC) that leaves their current mortgage in place and only charges an interest rate on the new amount borrowed to fund the construction. Also, most HELOCs have a floating rate meaning that if interest rates come down over the next two years they will benefit from lowering interest costs. Bottom Line: Homeowners can benefit from reduced financing costs because they can keep their existing low rate mortgage in place and get a floating rate HELOC to fund construction.

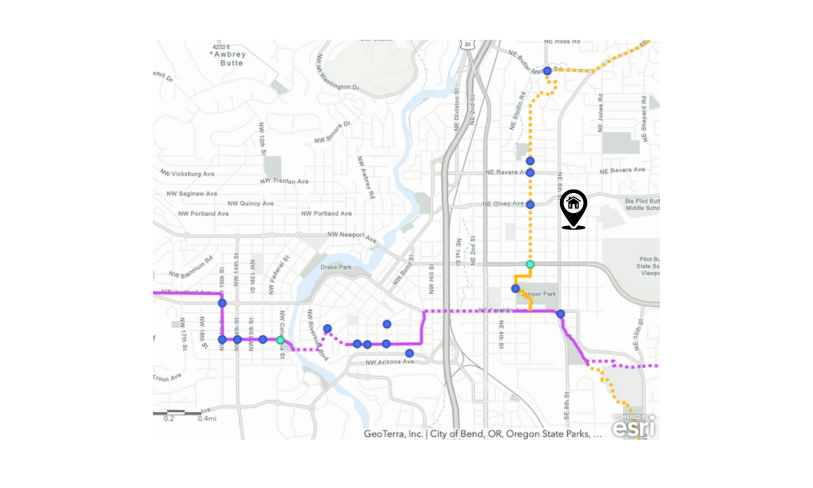

- Building an ADU pro: Tax incentives and grants Many cities see the benefits to neighborhoods for adding ADUs and they are creating tax incentives, grants, and other benefits to homeowners that are willing to add an ADU to their property – especially if the homeowner will keep their rents at a certain affordability level. For example, for Bend, Oregon the city will utilize a tax increment financing program to provide qualifying property owners a rebate on up to 80% of their property taxes. The City of Bend also offers grants to help qualifying projects that are offering housing to middle-income residents (defined as those earning between 80% and 120% of the local Area Median Income “AMI”). Bottom Line: Many cities are offering tax incentives, grants, or rebates that can make an ADU build pencil out very well.

BONUS Building an ADU Con: Infrastructure Cost Utility hookups, grading, rock hammering, sewers hookups, or septic systems and electrical connections are always a wildcard when it comes to new construction including adding an ADU. We have experienced multiple projects where the infrastructure requirements have killed a project’s financial feasibility. We do our best to conduct a thorough feasibility to ferret out potential infrastructure surprises and then we work with a infrastructure contractor to estimate the cost of site preparation and utility connections but there is always a risk of surprises that can increase costs. Bottom Line: Infrastructure construction including utility hookups and site work is a cost risk that a homeowner may not know exactly what they are committing to from a cost standpoint until they get into a project.