Interest Rates are Still Dragging on Real Estate

Author: Ryan Andrews, Hiatus Homes CFO & Managing Partner – Hiatus Capital Fund

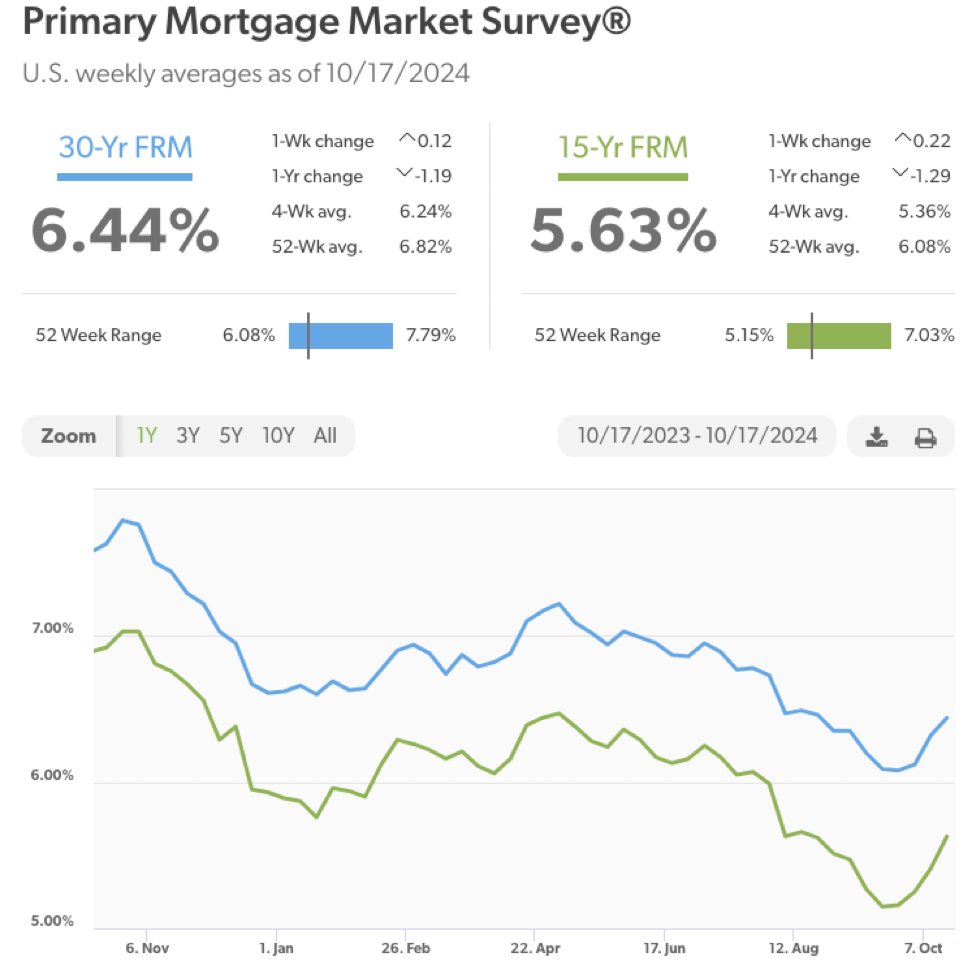

In September the Fed cuts rates by 50bps which was more than the 25bps the overall financial markets were predicting. This move prompted celebrations from many in the real estate industry with the hope that this would ease the slowdown in the real estate market. This rate cut was followed by labor market data that showed economic strength and inflation data that showed CPI didn’t come down as much as expected. These and other recent economic reports, which we outline below, decreased the likelihood of large interest rate cuts in November and December 2024. Often rates make large moves in anticipation of Monetary Policy and make small moves after the actual announcements. If you’d like to see our original reaction to the Fed’s cut, check out last week’s blog post.

Mortgage Rates are typically priced in two components: the 10-Year Treasury plus a ‘spread’ over the Treasury. The table below illustrates the movement in the 10Y Treasury yield, the mortgage spread, and the average 30-year fixed mortgage rate on the day after the Fed announced an interest rate cut, as well as a month later. As shown, the rise in mortgage rates can be attributed solely to the increase in the 10-Year Treasury yield.

| 9/18/24 | 10/18/24 | ||

| 10-Year Treasury Yield | 3.70% | 4.08% | 0.38% increase |

| Spread | 2.39% | 2.36% | .03% decrease |

| 30-Year Mortgage | 6.09% | 6.44% | 0.35% increase |

Why did the 10-Year Treasury go up? Let’s break down four simple reasons:

- Election and global political uncertainty

- The Labor and inflation reports

- Treasury Interest expense report

- Bifurcated Monetary Policy with quantitative tightening and lower interest rates

Over the last month the wars in the Middle East and Ukraine and have both escalated making financial markets nervous. On top of this the US election has created a pause-and-wait mentality for many investors with a lot of fiscal policy uncertainty until the election is determined. This is impacting the Treasury market and pushing up interest rates as interest rates tend to be a measure of economic stability. Additionally, many real estate investors are waiting to see the results of the election – especially because there are some major tax policy proposals which could impact real estate investments. This is driving up rates and slowing down real estate transactions.

The September employment report showed a nonfarm payrolls increase by 254,000 in September, the largest jump since March, and much higher than the forecast of 140,0002. Further, the inflation report printed that CPI came in at 2.4% when the forecast was 2.3%3. And the JOLTS (Job Opening and Labor Turnover Survey) showed job openings increased to 8.04 million from an expectation of 7.65 million4. All these reports prompted a statement from Fed Chairman Powell: “This is not a (policy-setting) committee that feels like it is in a hurry to cut rates quickly.” The data all combined to dampen investor expectations of another 50bps rate cut in November. This pushed up the 10-Year Treasury rate.

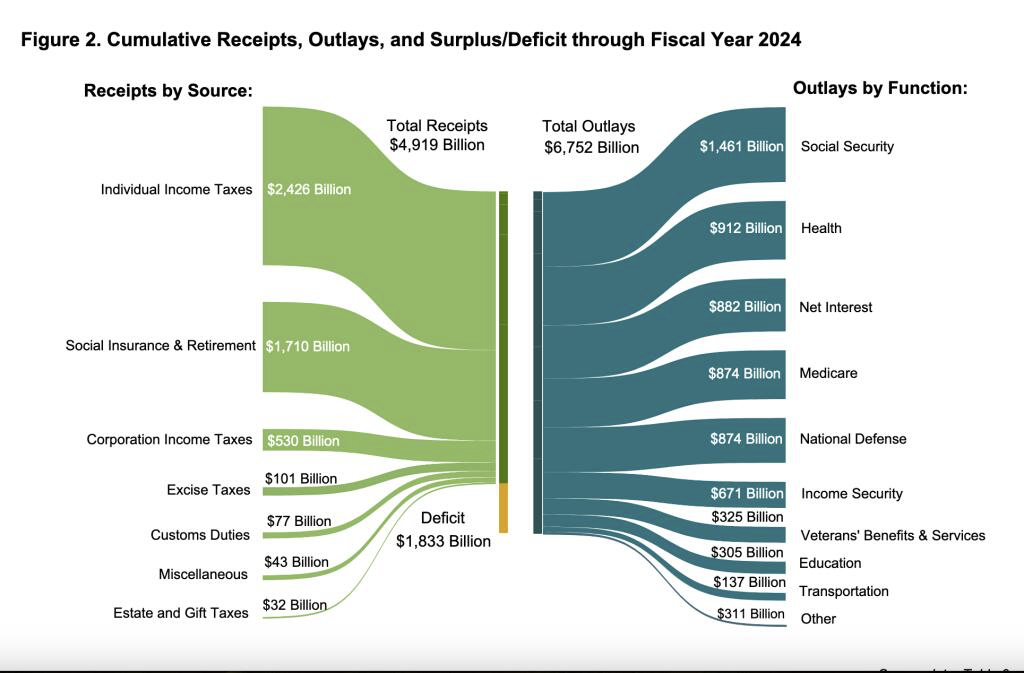

The Monthly Treasury Statement published on September 30, 20245 showed that for the first time in history interest payments on national debt topped defense spending: $882 billion vs. $874 billion. The total federal deficit was more than $1.8 Trillion in fiscal 2024 even though revenue was up by almost half a trillion. The market is nervous about the US getting itself into a debt trap where compounding interest creates economic drag.

2https://www.reuters.com/markets/us/us-job-growth-surges-september-unemployment-rate-falls-41-2024-10-04

3https://www.cnbc.com/2024/10/10/cpi-inflation-september-2024.html

5https://fiscal.treasury.gov/files/reports-statements/mts/mts0924.pdf

Fourth, despite the headline of the Fed’s monetary policy pivot, within the Fed’s announcement of the 50bps rate cut in September, Chairman Powell shared that the Fed would continue to drawdown its balance sheet6. Currently the Fed is allowing about $60 billion per month in Treasury and mortgage bond holdings to mature and not be replaced by re-investing. This puts overall downward pressure on the M2 Money Supply which puts a drag on the growth of the economy. There is an entire school of economics – Monetarism – that focuses on expansion and recession as primarily being the result of increases and decreases of money supply. The point is, although interest rates decreased, the Fed is still applying restrictive Monetary policy and the market is responding to this at least as much as it is to the interest rate cut.

Interesting note, my November 2023 Hiatus Investor Letter I stated: “I believe we may end up with a bifurcated monetary policy where the Fed keeps interest rates high but begins quantitative easing measures.” I got the bifurcated policy right, I just had the interest rates and the quantitative easing/tightening flipped. It took a 10 months but the Fed ended up lower interest rates but tightening the money supply.

TLDR (Too Long Didn’t Read) Conclusions:

- The Fed cut interest rates more than expected in September but Treasuries and thereby mortgage interest rates went up

- The positive economic reports in September have dampened the possibility of further interest rates cuts of the same magnitude

- The US Government is running huge deficits, in part driven by high interest rates. And the deficits themselves are driving high interest rates even higher.

- The Fed is now engaged in bifurcated monetary policy: tightening money supply while cutting interest rates

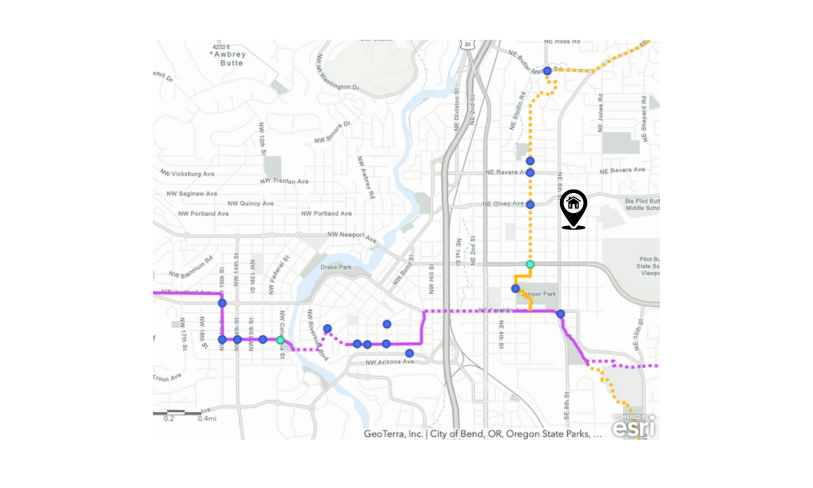

The Bend Housing Market

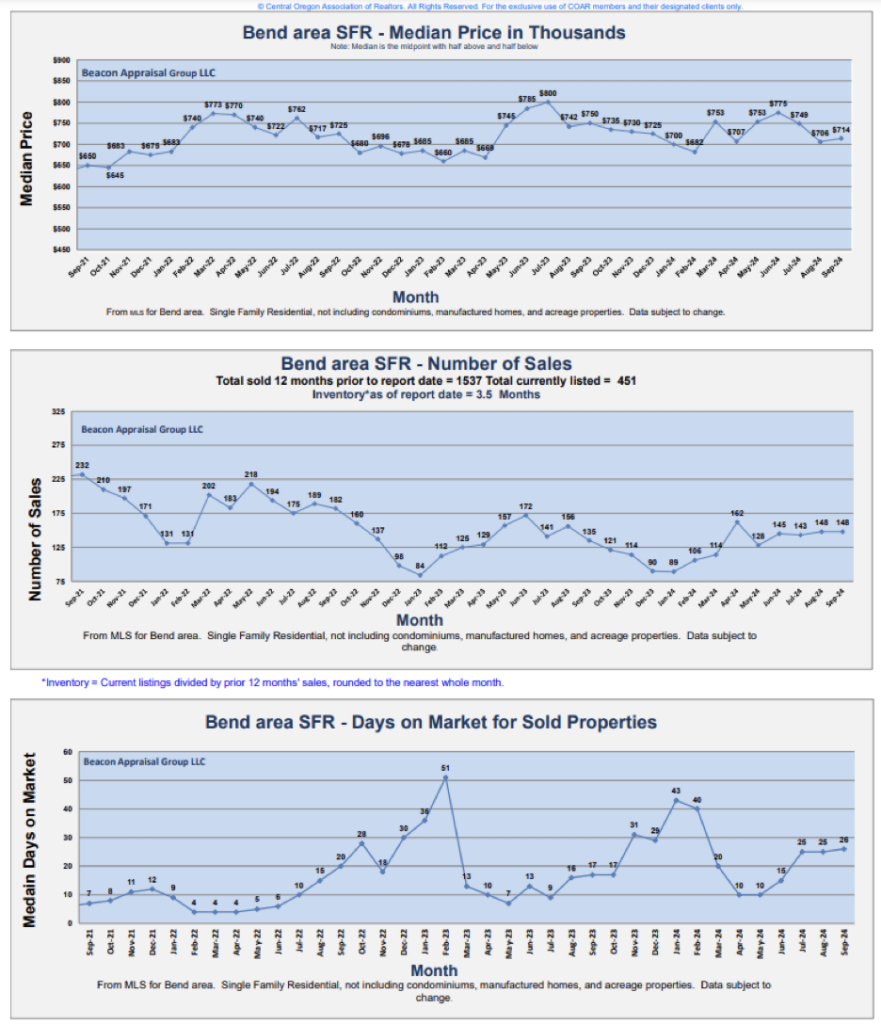

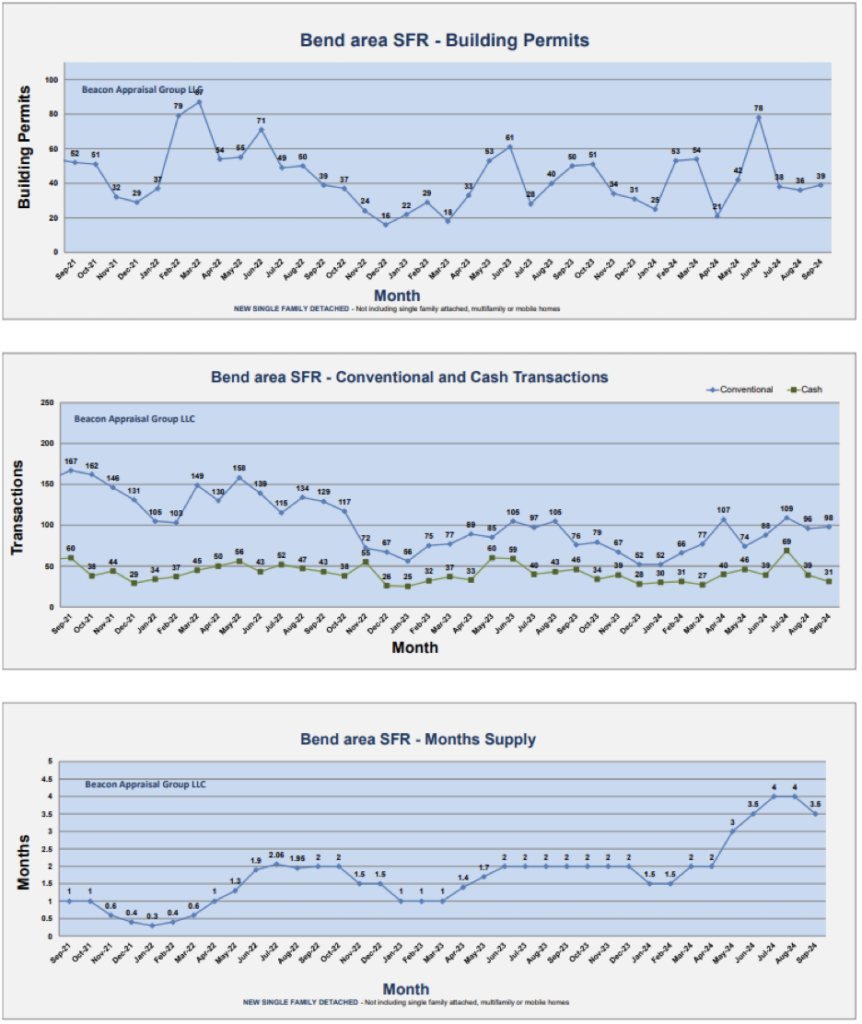

Locally the Bend housing market has flattened over the last three months. Median price still hovers in the low $700,000 range and number of sales has ranged between 145-148 since June. Days on Market for sold properties has come in around 25-28 days. New home building permits are clocking in around 36-39 per month and months supply ticked down to 3.5 months from 4 months.

Bend has reach a sort of new equilibrium at the current interest rates and home prices. An informal scan of Zillow shows lots of homes on the market for over 100 days and small-medium-and-large price cuts on many homes.

We had hoped for the beginning of a strong shifts in sales after the first interest rate cut, as discussed above, the fact that the Fed cut rates and mortgages went up put a damper on traditionally financed transactions.

TLDR Conclusions on the Bend Housing Market

We have not seen the increase in transactions we hoped for following a Fed rate cut, likely because Mortgages went up after the Fed cut the Fed Funds Rate. The local market has reached some stability the last few months at around a $700,000 median home price and 145 transactions a month and 3.5-4 months supply of homes for sale.